hotel-rosa-ski-inn.online

Market

Avoid Taxes On Home Sale

To avoid paying more than they have to in taxes, many property investors take advantage of opportunities such as the exchange process or “home sale. Buying another home to defer (yes, defer not avoid) capital gains taxes was eliminated nearly 25 years ago. Now you have to live in the home as. Luckily, there is a tax provision known as the "Section Exclusion" that can help you save on taxes following a home sale. In simple terms, this capital. But, if you make a profit, you can often exclude it. This is called “home sale exclusion”, or less commonly “sale of a personal residence exclusion”. Taxes for. Selling stocks? 3 ways to help trim your tax bill · Capital gain. Your profit when you sell a stock, house or other capital asset. · Wash-sale rule. A tax law. So if the heir(s) sell the home, at market value, say $1,,, no capital gains tax would apply at sale if the net sales price was $1,, Subtract your full cost basis in the home from the sale price to arrive at your taxable profit. Keeping accurate records of your basis can help you when it. Most people who sell their personal residences qualify for a home sale tax exclusion of $, for single homeowners and $, for marrieds filing jointly. Section of the Internal Revenue Code allows real estate investors who sell one investment property and purchase another 'like-kind' property to defer. To avoid paying more than they have to in taxes, many property investors take advantage of opportunities such as the exchange process or “home sale. Buying another home to defer (yes, defer not avoid) capital gains taxes was eliminated nearly 25 years ago. Now you have to live in the home as. Luckily, there is a tax provision known as the "Section Exclusion" that can help you save on taxes following a home sale. In simple terms, this capital. But, if you make a profit, you can often exclude it. This is called “home sale exclusion”, or less commonly “sale of a personal residence exclusion”. Taxes for. Selling stocks? 3 ways to help trim your tax bill · Capital gain. Your profit when you sell a stock, house or other capital asset. · Wash-sale rule. A tax law. So if the heir(s) sell the home, at market value, say $1,,, no capital gains tax would apply at sale if the net sales price was $1,, Subtract your full cost basis in the home from the sale price to arrive at your taxable profit. Keeping accurate records of your basis can help you when it. Most people who sell their personal residences qualify for a home sale tax exclusion of $, for single homeowners and $, for marrieds filing jointly. Section of the Internal Revenue Code allows real estate investors who sell one investment property and purchase another 'like-kind' property to defer.

If you sell your home, you may exclude up to $ of your capital gain from tax ($ for married couples), but you should learn the fine print first. While the federal income tax home sale gain exclusion break is still on the books, it's only available for the sale of a principal residence.1 That said, a. In this case, you can exempt up to $, in capital gains — or $, for married couples filing jointly — from the sale of your home. If you made less. In order to take advantage of this tax loophole, you'll need to reinvest the proceeds from your home's sale into the purchase of another “qualifying” property. Capital Gains Tax on Home Sales vs. Rental Properties. The short version: homeowners get an exemption on capital gains tax (under some circumstances). Landlords. Relief from Capital Gains Tax (CGT) when you sell your home - Private Residence Relief, time away from your home, what to do if you have 2 homes. General tax questions · The property was located in Washington in the same year or the year before the sale took place. · The individual was a Washington resident. If during the tax year you realized capital gain through the sale of property, you can offset it with capital losses. Several years ago, we sold our house and. When a taxpayer sells a capital asset, such as stocks, a home, or business assets, the difference between the sale price and the asset's tax basis is either a. For the sale to be exempt from the capital gains tax, the home must have been considered the primary residence for at least two years of the last five years. Of the $, gain from the home sale ($1,, - $,), $, is tax-free and $20, is taxed at long-term capital gains rates. Selling a primary. Another way to avoid capital gains taxes on inherited property is to rent it out. This can allow you to keep the property and turn it into a money-generating. house or used it for any other purpose, John would have to pay PA income tax on any gain he realized from the sale of his Harrisburg home. (3) Ownership. The primary residence tax exemption Unlike other investments, home sale profits benefit from capital gains exemptions that you might qualify for under some. Another strategy is to consider a exchange, which allows you to defer paying capital gains tax by reinvesting the proceeds from the sale of one property. Another strategy is to consider a exchange, which allows you to defer paying capital gains tax by reinvesting the proceeds from the sale of one property. By converting your rental into a primary residence, single taxpayers can exclude up to $, from the sale of the property. Married taxpayers can exclude up. Use the Exchange A exchange helps you defer paying capital gains taxes when selling an investment property and using the profits to purchase another. You don't have to pay taxes on the first $k (or $k if married filing jointly) of capital gains if you've used the house as your primary. Typically, the gain realized from the sale of an individual's "main home" qualifies for a complete or partial exclusion from federal income tax that releases.

Infineon Stock Price Today

Key Data. Exchange. Other OTC. Today's High/Low. $/$ INFINEON hotel-rosa-ski-inn.online Price data ; Market Capitalization, 43, mn ; Open, ; High, ; Low, ; Monthly Performance (MOM), +%. PREV. CLOSE. ; VOLUME. 4,, ; MARKET CAP. B ; DAY RANGE. – ; 52 WEEK RANGE. – Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Home · About Infineon · Investor; Infineon Share. Infineon Share. Ordinary Shares; ADS; Dividend; Share Buyback Program ; Analyst Coverage; Consensus. Infineon Technologies AG headquartered in Munich, was spun off from German industrial conglomerate Siemens in and today is one of Europe's largest. Real time Infineon Technologies Ag (IFNNY) stock price quote, stock graph, news & analysis. Infineon | IFXStock Price | Live Quote | Historical Chart ; NXP Semiconductors, , , % ; Qualcomm, , , %. Infineon Technologies AG ADR · · Partner Center · Your Watchlists · Recently Viewed Tickers · IFNNY Overview · Key Data · Performance · Analyst Ratings. Key Data. Exchange. Other OTC. Today's High/Low. $/$ INFINEON hotel-rosa-ski-inn.online Price data ; Market Capitalization, 43, mn ; Open, ; High, ; Low, ; Monthly Performance (MOM), +%. PREV. CLOSE. ; VOLUME. 4,, ; MARKET CAP. B ; DAY RANGE. – ; 52 WEEK RANGE. – Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Home · About Infineon · Investor; Infineon Share. Infineon Share. Ordinary Shares; ADS; Dividend; Share Buyback Program ; Analyst Coverage; Consensus. Infineon Technologies AG headquartered in Munich, was spun off from German industrial conglomerate Siemens in and today is one of Europe's largest. Real time Infineon Technologies Ag (IFNNY) stock price quote, stock graph, news & analysis. Infineon | IFXStock Price | Live Quote | Historical Chart ; NXP Semiconductors, , , % ; Qualcomm, , , %. Infineon Technologies AG ADR · · Partner Center · Your Watchlists · Recently Viewed Tickers · IFNNY Overview · Key Data · Performance · Analyst Ratings.

Infineon Technologies AG IFNNY:OTCQX ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High

Infineon Technologies AG (hotel-rosa-ski-inn.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Infineon Technologies AG | Xetra: IFX. Infineon Technologies AG ADR (IFNNY) Infineon Technologies AG ADR stock price live, this page displays OTC IFNNY stock exchange data. View the IFNNY premarket. INFINEON TECHNOLOGIES ; Since Open. (%) ; Since Previous Close. + (+%) ; Valuation Close. € Will Infineon stock go up? arrow-icon. According to Danelfin AI, Infineon has today an AI Score of 5/10 (Hold rating), because its probability. Find the latest Infineon Technologies AG (hotel-rosa-ski-inn.online) stock quote, history, news and other vital information to help you with your stock trading and investing. Get the Infineon Technologies AG stock price history at IFC Markets. Watch daily IFX share price chart and data for the last 7 years to develop your own. Price/Earnings ttm ; Earnings Per Share ttm ; Most Recent Earnings $ on 08/05/24; Next Earnings Date. Key Data. Open €; Day Range - ; 52 Week Range - ; Market Cap €B; Shares Outstanding B; Public Float B; Beta Last Price. € ; Market Cap. €b ; 7D. % ; 1Y. % ; Updated. 01 Sep, Get the latest Infineon Technologies AG (IFX) real-time quote, historical performance, charts, and other financial information to help you make more. The Infineon Technologies AG NA O.N. stock price today is What Is the Stock Symbol for Infineon Technologies AG NA O.N.? The stock ticker symbol for. Infineon Technologies AG ADR ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Infineon (IFNNY) has a Smart Score of 5 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. Infineon Technologies AG engages in the provision of semiconductor and system solutions. It operates through the following segments: Automotive; Industrial. About Infineon Technologies AG (IFNNY) ; Price / earnings ratio. x ; Today's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ ; 5. See the latest Infineon Technologies AG ADR stock price (IFNNY:PINX), related news, valuation, dividends and more to help you make your investing decisions. Infineon Technologies AG - Stock Price History | IFNNY ; QuickLogic (QUIK), United States, $B · ; AXT Inc (AXTI), United States, $B · What is Infineon Technologies AG(IFNNY)'s stock price today? The current price of IFNNY is $ The 52 week high of IFNNY is $ and 52 week low is $ The latest Infineon stock prices, stock quotes, news, and IFNNF history to help you invest and trade smarter. See the latest Infineon Technologies AG stock price (IFX:XFRA), related news today is one of Europe's largest chipmakers. The company is a leader.

Rates Dropped Today

“Based on current data, it is hard to envision more than one to two cuts in and hard to see mortgage rates drop below %.” hotel-rosa-ski-inn.online: year fixed-rate. Broker said that rates should be lower, but they're falling really slowly. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. Explore today's mortgage rates and compare home loan options. When you Have you been putting off buying a home, hoping that mortgage rates will drop? Mortgage rates dropped to their lowest level since early February after the Federal Reserve set the stage for a September interest rate cut. The. Mortgage rates drop or rise daily, reacting to changing economic conditions, central bank policy decisions, and investor sentiment. The table below shows recent. September 12, Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates. For instance, your actual rate quote could drop from % to % in a Today's Mortgage Rates | Mortgage Calculators · 9/13/ 30 Yr. Fixed Rate. Today's market data also points towards more short-term upward pressure on mortgage rates, though next week's highly anticipated, highly probably Fed cut looms. “Based on current data, it is hard to envision more than one to two cuts in and hard to see mortgage rates drop below %.” hotel-rosa-ski-inn.online: year fixed-rate. Broker said that rates should be lower, but they're falling really slowly. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. Explore today's mortgage rates and compare home loan options. When you Have you been putting off buying a home, hoping that mortgage rates will drop? Mortgage rates dropped to their lowest level since early February after the Federal Reserve set the stage for a September interest rate cut. The. Mortgage rates drop or rise daily, reacting to changing economic conditions, central bank policy decisions, and investor sentiment. The table below shows recent. September 12, Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates. For instance, your actual rate quote could drop from % to % in a Today's Mortgage Rates | Mortgage Calculators · 9/13/ 30 Yr. Fixed Rate. Today's market data also points towards more short-term upward pressure on mortgage rates, though next week's highly anticipated, highly probably Fed cut looms.

Thirty-year fixed mortgage rates dropped to their lowest level since February , down from % last week, to an average of %. "Rates continue to. In the same period last year, the rate on a year benchmark mortgage was %. “Mortgage rates have fallen more than half a percent over the last six weeks. current mortgage rates, and loan types We'll waive our lender closing costs on your next refinance if rates drop—that's a savings of $1,! It marks a sixth consecutive week of falling borrowing costs, staying below % a year ago, as prospects the Fed will soon start cutting the interest rates. “Mortgage rates have already dropped to the mid-6% level following news that the Fed is expected to begin cutting rates at their September meeting, and they may. I just closed on a house, and now mortgage rates have dropped significantly. If you can benefit from today's low rates, do it. Waiting. This means you can ask to adjust your locked rate to match the current, lower market rate. Checking the Fine Print: It's crucial to understand that Mortgage. Mortgage interest rates dropped to their lowest level since February The Today's mortgage rates are based on a daily survey of select lending. Mortgage rates have fallen quite a bit since the late peak. According to the latest data from the Mortgage Bankers Association, the average interest rate. What's the story with mortgage rates? FRED Blog. Two takeaways on mortgage rate data. FRED Blog. Inflation and the cost of tighter. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Sept. “Mortgage pricing should be flat to slighly lower today. We had a lot of chatter last night about a basis point rate cut, sending yields. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Friday. The day before ADP mortgage rates dropped on a weaker-than-expected JOLTS Current Mortgage Rates This Week for WA, OR, ID, CA, and CO From. Mortgage rates have fallen quite a bit since the late peak. According to the latest data from the Mortgage Bankers Association, the average interest rate. “Mortgage rates have been on a downward trajectory throughout the summer homebuying season, but only in recent weeks have rates fallen meaningfully lower. Mortgage rates have already declined by over half a percentage point (%) between May and September. Although the Federal Open Market Committee hasn't yet cut. Homebuyers continue to keep a close eye on mortgage rates, hoping for a decrease that could lower borrowing costs. Although rates peaked last year.

Tax Free Side Jobs

As a side hustler, you're considered to be self-employed in the eyes of the IRS. That means you will need to report and pay taxes on this income stream. It's important to remember that while you can claim the tax-free threshold from your primary job—currently $18, for the financial year—you can't. Whether it's carpentry, knitting, painting, jewelry making, or crafting, these hobbies can serve as the foundation for many unique side hustles. How a Crafter. Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Employees who receive a W-2 only pay half of the. Revenues from a side hustle or second job are taxable and deductions are available to businesses. Filing is straightforward with the T form. The term “gig” used in this guide refers to a job for a specified period. The gig economy is based on flexible, temporary, or freelance jobs, often involving. Virtual assistance offers a flexible way to earn income by providing remote administrative, technical, or creative support to clients. Tasks typically include. The difference between a job and a side hustle in the eyes of HMRC is how much you earn. Earnings of less than £ in one tax year are not considered taxable. The self-employment tax is % of profits. As a side hustler, you are both the employer and employee, so you need to pay both sides of the social security tax. As a side hustler, you're considered to be self-employed in the eyes of the IRS. That means you will need to report and pay taxes on this income stream. It's important to remember that while you can claim the tax-free threshold from your primary job—currently $18, for the financial year—you can't. Whether it's carpentry, knitting, painting, jewelry making, or crafting, these hobbies can serve as the foundation for many unique side hustles. How a Crafter. Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Employees who receive a W-2 only pay half of the. Revenues from a side hustle or second job are taxable and deductions are available to businesses. Filing is straightforward with the T form. The term “gig” used in this guide refers to a job for a specified period. The gig economy is based on flexible, temporary, or freelance jobs, often involving. Virtual assistance offers a flexible way to earn income by providing remote administrative, technical, or creative support to clients. Tasks typically include. The difference between a job and a side hustle in the eyes of HMRC is how much you earn. Earnings of less than £ in one tax year are not considered taxable. The self-employment tax is % of profits. As a side hustler, you are both the employer and employee, so you need to pay both sides of the social security tax.

The money you earn on side gigs are considered “self-employment,” and you can file it with your personal income tax return. The IRS reports that tax evasion. Since most side hustle jobs will not deduct taxes automatically from your paycheck like a full-time job will, it's important to maximize your tax deductions so. Ideas for side hustles · Freelance copywriting and graphic design: If your day job involves marketing or journalism, freelancing can be a great fit. · Sell. Self-employment tax is a tax-deductible expense. The IRS allows you to If you earn $ or more annually from self-employment, including side jobs. Any sort of income is taxable. They even ask if you made any tips throughout the year so they can tax you on that too but 9/10 times if you're. Technically yes. Any sort of income is taxable. They even ask if you made any tips throughout the year so they can tax you on that too but. This is called the Personal Allowance and is £12, for the /25 tax year. You only get one Personal Allowance – so it's usually best to have it applied to. If your side gig made less than $30, last year, you don't need to worry about collecting or paying GST. Once you hit more than $30,, you'll need to. The practice of earning extra money doing something outside your regular job, Irish Examiner reports. A side hustle can be anything from offering private. Whether you're obligated to pay taxes or not depends on your secondary employment and how much you earn. Secondary income usually comes from a second job, self-. What are side hustle taxes? · You have to pay self-employment tax on side hustles if you make $ or more in net income. · You should receive any forms. If you earn over € in additional non-employment income per year in Germany, you need to pay taxes on it. The specific amount you owe depends. If you have a second job, such as a part-time role in a restaurant and you get paid through PAYE, you won't have to declare it to HMRC. The tax authority will. Side gig income may feel like something you do in your spare time for some extra cash, but it's actual taxable income. Now, if your side gig is your only income. Gig economy income is taxable · From part-time, temporary or side work · Not reported on an information return form — like a Form K, MISC, NEC, W A side hustle is a great way to bring in extra income outside your regular job. But, just because you're earning a little extra cash on your terms doesn't. tax free income jobs · Tax Accountant · $50, - $60, · Mental Health Therapist · $45 - $50 · Tax Preparer (CPA/EA) · $25 - $40 · Food Service Worker / Part-time. Each year you'll need to report your taxable income and any tax expenses you wish to claim to HMRC via a Self Assessment tax return (the SA) plus. If you make more than $ from your side job, you'll need to file a Schedule SE and pay Social Security and Medicare taxes on the income. Alimony — If you. If you're confident that your combined income from all your employers will be $18, or less, you can claim the tax-free threshold from all of them. But if.

Defined Contribution Pension Plan Definition

If you're a member of a pension scheme through your workplace, then your employer usually deducts your pension contributions from your salary before it is taxed. Defined Contribution (DC) Plan - A pension plan in which contributions are made to an individual account for each employee. The retirement benefit is not pre-. A defined contribution plan is a retirement plan in which an employee contributes money and their employer makes a matching contribution. In contrast to traditional pensions, the VDC can follow you if you change jobs. The VDC is your personal retirement account, and is supported by employer and. Defined benefit plans provide a predetermined payout. Defined contribution plans require or permit employees, and sometimes employers, to make contributions up. In a DB plan the member and their employer make contributions which are then pooled in the pension fund and invested by experts. The member's pension is paid. A defined-contribution plan allows employees to contribute and invest in funds and other securities over time to save for retirement. With defined benefit plans, retirement assets are pooled, and the investment risk is shared. These plans are usually administered by professional managers. A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. If you're a member of a pension scheme through your workplace, then your employer usually deducts your pension contributions from your salary before it is taxed. Defined Contribution (DC) Plan - A pension plan in which contributions are made to an individual account for each employee. The retirement benefit is not pre-. A defined contribution plan is a retirement plan in which an employee contributes money and their employer makes a matching contribution. In contrast to traditional pensions, the VDC can follow you if you change jobs. The VDC is your personal retirement account, and is supported by employer and. Defined benefit plans provide a predetermined payout. Defined contribution plans require or permit employees, and sometimes employers, to make contributions up. In a DB plan the member and their employer make contributions which are then pooled in the pension fund and invested by experts. The member's pension is paid. A defined-contribution plan allows employees to contribute and invest in funds and other securities over time to save for retirement. With defined benefit plans, retirement assets are pooled, and the investment risk is shared. These plans are usually administered by professional managers. A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis.

Summary · The defined-contribution plan is a type of pension fund to which an employee and/or an employer contribute based on terms agreed to by both parties. In a defined contribution plan, your contributions are kept in a separate individual fund, invested by you. You bear all of the risk with this type of plan. With the defined contribution part of the plan, you invest part of each paycheck into a retirement fund. When you retire, the amount you earn depends on the. It lists the service credit you earned, contributions you made, and interest you earned on your contributions during the year and over the course of your. In a defined contribution plan, the actual amount of retirement benefits provided to an employee depends on the amount of the contributions as well as the gains. Defined-Contribution (DC) Pension Plans This is the type of pension plan most commonly offered by employers. The benefits are based on contributions and. FERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. CalSTRS Defined Benefit Program is a traditional defined benefit plan that provides retirement, survivor and disability benefits. A defined contribution plan means there is a set amount of money (that may change each year) paid into a member's retirement account. Money is paid by both the. Defined contribution plans - (k), profit-sharing, and other defined contribution plans generally pay retirement benefits in a lump sum or installments. Summary · The defined-contribution plan is a type of pension fund to which an employee and/or an employer contribute based on terms agreed to by both parties. Defined Contribution (DC) pension plans define the amount of required contributions to the pension plan. A member's pension benefits are based on. A defined benefit pension plan is a pension plan that guarantees employees a specific monthly benefit at retirement. It does not define the cost to the plan. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. In a defined contribution plan, the employer (and, often, the employee as well) makes specific contributions to an employee's pension fund, and the amount of. An employer-sponsored retirement savings plan, authorized by Congress, where contributions are put in an investment account managed by the employee. Generally. What exactly is a Defined Contribution Pension Scheme? A Defined Contribution (DC) pension scheme is a type of workplace pension where a fund of money is. A defined benefit plan is one set up to provide a predetermined retirement benefit to employees or their beneficiaries. Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination.

Sample Of White Paper

White papers are more technical and in-depth than other types of content, such as blogs and case studies. They use research, statistics, expert opinions and. Click here to download an example of a white paper, The Indeed Workbook, which features tips, activities and inspiration for the job hotel-rosa-ski-inn.onlineers. 10 great white paper examples · 1. Lit in Colour: Taking down barriers to a more representative English curriculum · 2. Accelerating Change: Improving. Looking for white paper design ideas and inspiration? We've collected thousands of the best examples of white paper designs, templates, photos & images from. White Paper Library. Topics & Tools · Tools & Samples; Whitepapers documents. Offered by: Adobe Knowledge workers face info overload. Use graphs, charts, and images to illustrate points you're making in the text. Our ready-made whitepaper template design will make your whitepaper data. A problem/solution white paper describes a nagging industry problem, all the existing solutions and their drawbacks, and then a new, improved approach that. Key Benefits of Making Your White Paper on hotel-rosa-ski-inn.online · Collaborate in real-time · Interlink white papers and other documents · Create fully responsive documents. A white paper template is a pre-designed document that provides a framework and structure for creating a white paper. It typically includes a set of guidelines. White papers are more technical and in-depth than other types of content, such as blogs and case studies. They use research, statistics, expert opinions and. Click here to download an example of a white paper, The Indeed Workbook, which features tips, activities and inspiration for the job hotel-rosa-ski-inn.onlineers. 10 great white paper examples · 1. Lit in Colour: Taking down barriers to a more representative English curriculum · 2. Accelerating Change: Improving. Looking for white paper design ideas and inspiration? We've collected thousands of the best examples of white paper designs, templates, photos & images from. White Paper Library. Topics & Tools · Tools & Samples; Whitepapers documents. Offered by: Adobe Knowledge workers face info overload. Use graphs, charts, and images to illustrate points you're making in the text. Our ready-made whitepaper template design will make your whitepaper data. A problem/solution white paper describes a nagging industry problem, all the existing solutions and their drawbacks, and then a new, improved approach that. Key Benefits of Making Your White Paper on hotel-rosa-ski-inn.online · Collaborate in real-time · Interlink white papers and other documents · Create fully responsive documents. A white paper template is a pre-designed document that provides a framework and structure for creating a white paper. It typically includes a set of guidelines.

White papers are commonly at least 2, words in length and written in an academic style. A white paper should provide well-researched information that is not. white paper content It is important to emphasize your readers' interests rather than your interests, as shown in the example below. Using adaptive design in an exploratory setting can allow, for example, evaluation of a broad range of doses, regimens, and populations, giving investigators. In this paper, Dr. Jeff Cohn discusses real-world examples of the causes of moral distress and simple practices to improve moral resilience. Download this white. 8 Easy Steps On How to Write a White Paper · 1. Identify the topic · 2. Determine the objectives · 3. Let experts be the authors · 4. Use visuals · 5. Provide. Read Whitepaper. Larger Samples. Larger and More Representative Sample Size. See how the Location-Based Services (LBS) data that drives the StreetLight InSight. Professional white paper in A4; 8-pt baseline grid. Configurable colors, text styles, logos, and more. Pages included: Title page (2 variations)Table of. 7 Steps to the Perfect White Paper (Template & Examples) · Step 1: Make the White Paper Count · Step 2: Put Together an Easy-to-Read Title Page · Step 3. White papers: A step-by-step guide to writing them with examples. White Paper. LeadsJuly 2, When writing a white paper, avoid giving them sales pitch vibes. White papers should be unbiased and educational, not a sales pitch. To achieve this, it is. White papers follow a problem-solution structure. The main sections of a white paper may include an executive summary, an introduction or a section on. White papers are also useful in attracting collaborators (other faculty, other universities, advisory board members, etc.) to join in the work of the project. White paper free templates This simple white paper template is the perfect way to describe the designs and present the results of the studies. You can use. The templates work in all versions of MS Word for Office and MS Word for Apple. Each of the templates are easy to modify. You can edit, update, and remove any. Free Editable White Paper Templates from hotel-rosa-ski-inn.online are great resources to have when writing a white paper document. Our template designs range from modern. An example of a white paper that has been created solely to market the company's solutions. It explains the need for change in discrete product sales and other. The typical technical white paper format is between six and 12 pages long, including the cover sheet. Anything shorter is unlikely to convey enough appropriate. MANDATORY ENHANCED WHITE PAPER TEMPLATE. (Max 16 pages including cover page Sample: This Enhanced White Paper includes data that shall not be. White Paper Examples. White papers are documents that discuss complex issues to solve complex problems. It will help you decide on your business about an. A white paper is a deeply researched report on a specific topic that presents a solution to a problem within an industry. It is usually written by a company to.

Personal Driver Monthly Cost

Personal Driver Service in Los Angeles, CA. The Nation's #1 Largest Personal Make Driving Around Los Angeles Easy. schedule your driver now. See Rates. Enjoy your own private personal driver that takes you where ever you want to go,when your hotel-rosa-ski-inn.online high end modern air condition, clean, luxury vehicles and. Part time drivers may earn 10 to 20 thousands per month, otherwise in regular job they may earn Rs 25 thousands pm. Personal Drivers ; 10 hrs/day. Sunday. Rs/Month. Rs ; 12 hrs/day. Saturday & Sunday. Rs/Month. Rs ; 12 hrs/day. Sunday. Rs/Month. Rs Book luxurious cars with personal driver Dubai service from White Line Limousine LLC at the cheapest rates. Contact us at + 55 and save up to 50%. Need help from a personal driver for a day, week, month? * Reach out and How Much Does It Cost To Hire A Personal Driver In Chicago. Private Driver. Q1: How much does a personal driver cost per month? A: The cost can range from $3, to $8, per month, depending on factors such as hourly rates, daily. Full Time Personal Driver Salary in Florida. Hourly. Yearly; Monthly The possibility of a lower cost of living may be the best factor to use when. Monthly Personal Driver · 5 days a week, 10 hours a day, AED 5, per month. · 6 days a week, 10 hours a day, AED 6, per month. · 6 days a week, 12 hours a day. Personal Driver Service in Los Angeles, CA. The Nation's #1 Largest Personal Make Driving Around Los Angeles Easy. schedule your driver now. See Rates. Enjoy your own private personal driver that takes you where ever you want to go,when your hotel-rosa-ski-inn.online high end modern air condition, clean, luxury vehicles and. Part time drivers may earn 10 to 20 thousands per month, otherwise in regular job they may earn Rs 25 thousands pm. Personal Drivers ; 10 hrs/day. Sunday. Rs/Month. Rs ; 12 hrs/day. Saturday & Sunday. Rs/Month. Rs ; 12 hrs/day. Sunday. Rs/Month. Rs Book luxurious cars with personal driver Dubai service from White Line Limousine LLC at the cheapest rates. Contact us at + 55 and save up to 50%. Need help from a personal driver for a day, week, month? * Reach out and How Much Does It Cost To Hire A Personal Driver In Chicago. Private Driver. Q1: How much does a personal driver cost per month? A: The cost can range from $3, to $8, per month, depending on factors such as hourly rates, daily. Full Time Personal Driver Salary in Florida. Hourly. Yearly; Monthly The possibility of a lower cost of living may be the best factor to use when. Monthly Personal Driver · 5 days a week, 10 hours a day, AED 5, per month. · 6 days a week, 10 hours a day, AED 6, per month. · 6 days a week, 12 hours a day.

How much does it cost to rent a limo? SAFE DRIVER COST IN DUBAI · Call: + · HIRE A SAFE DRIVER @ 80 AED IN DUBAI · HIRE A SAFE DRIVER IN DUBAI HOURLY MONTHY OR WEEKLY · Address · Contacts. The above rates include Modest Driver Gratuity. Rates do not include Parking or Fuel Surcharge. Meet & greet at baggage claim at an additional $ 15% Fuel. This can be a massive boost to your productivity, and in many cases, pay for the costs of the personal driver on its own. month, or for a luxury car up to. A personal driver's pay ranges from $75, to $, annually. The exact amount will depend on various factors like: The driver's skill level; The scope of. Valid Texas driver's license. Monthly bonuses are based on a team goal as well as personal sales and are up to $2,+. Our residential garage door. Your private driver will prioritise safety and abide by local traffic rules driving responsibly. What is the cost of a personal driver in Toronto, Canada? A. That service starts from one day and it costs $ for a hour day. If you want to hire a personal driver for the week or for a month, contact us at. Chauffeurs Unlimited charges $ per hour plus a suggested 15% gratuity ($ per hour) for a total of $ per hour. There is a three hour minimum on all. SAFE DRIVER COST IN DUBAI · Call: + · HIRE A SAFE DRIVER @ 80 AED IN DUBAI · HIRE A SAFE DRIVER IN DUBAI HOURLY MONTHY OR WEEKLY · Address · Contacts. While ZipRecruiter is seeing hourly wages as high as $ and as low as $, the majority of Full Time Personal Driver wages currently range between $ Exceptional Service. A+ BBB rated. Personal drivers for half-the-cost. Half-the I plan to book another driver next month! Parke L | CT, United States. Looking for a designated driver or personal chauffeur in New York? Make Driving Around New York Easy. schedule your driver now. See Rates. Local. Hire only the best New York chauffeur services. For private driver in your business and personal trips, My Private Driver is your personal chauffeur. Need help from a personal driver for a day, week, month? * Reach out and How Much Does It Cost To Hire A Personal Driver In Chicago. Private Driver. Rates. What are the personal driver rates? We are pleased to inform you that hiring a private driver in Los Angeles, Orange County, Riverside, and San Diego. Leave the Headaches of Driving Behind with Your Own Personal Driver Ditch the costs and headaches of car ownership for a simple monthly driver fee. Are you looking for a Limo service with a Private Driver Chicago? Or Personal Driver Chicago with Private Driver for Chicago and O'Hare Airport Including. For a personal driver that will drive your car, the rates can range anywhere from $20 to $40 per hour. Limopedia chauffeur service is going to have a five hours. Budget: monthly. Project details: I am looking for a driver to take Personal Driver cost estimates. Babysitting cost · House Cleaning cost · Private.

How Much Power Does Crypto Mining Use

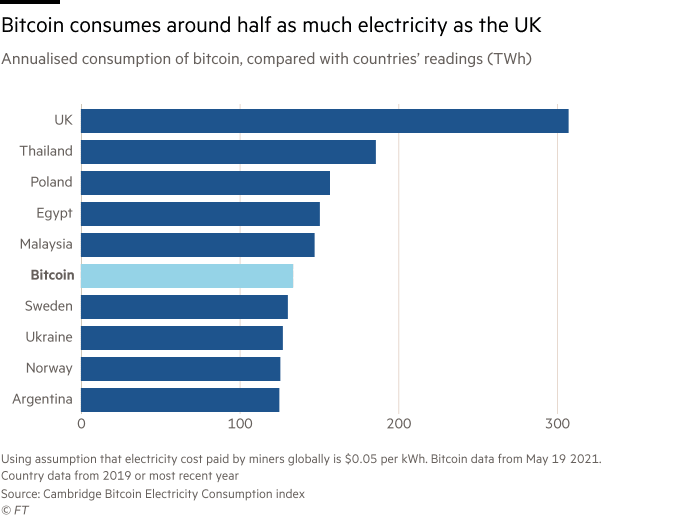

The CBECI estimates that global electricity usage associated with Bitcoin mining ranged from 67 TWh to TWh in , with a point estimate of. Bitcoin requires a significant amount of energy, estimated to consume about 91 terawatt-hours (TWh) of electricity annually, which is more than Finland uses. The number of VISA transactions that could be powered by the energy consumed for a single Bitcoin transaction on average ( kWh). Carbon Footprint. Since the world uses over , TWh of energy per year, that means that the entire Bitcoin network, at its peak consumption level, uses less than % of the. How Is Energy Spent to Mine Bitcoin? Energy is spent in the form of electricity, which powers the computers of Bitcoin miners. These miners try to add new. A single rig with three GPUs requires a minimum of watts of power when operating. This is about the same as using a medium sized window-based air. Typically, a rig will need at least Watts of power to run one or two GPUs and several fans needed to cool down the hardware. Some more. Bitcoin has an electricity consumption of TWh per year – that's more than entire countries such as Argentina and Ukraine, which consume and 0 ; Historical annualised electricity consumption · Annualised consumption. Power demand · Estimated consumption Annualised electricity consumption, ; Total Bitcoin. The CBECI estimates that global electricity usage associated with Bitcoin mining ranged from 67 TWh to TWh in , with a point estimate of. Bitcoin requires a significant amount of energy, estimated to consume about 91 terawatt-hours (TWh) of electricity annually, which is more than Finland uses. The number of VISA transactions that could be powered by the energy consumed for a single Bitcoin transaction on average ( kWh). Carbon Footprint. Since the world uses over , TWh of energy per year, that means that the entire Bitcoin network, at its peak consumption level, uses less than % of the. How Is Energy Spent to Mine Bitcoin? Energy is spent in the form of electricity, which powers the computers of Bitcoin miners. These miners try to add new. A single rig with three GPUs requires a minimum of watts of power when operating. This is about the same as using a medium sized window-based air. Typically, a rig will need at least Watts of power to run one or two GPUs and several fans needed to cool down the hardware. Some more. Bitcoin has an electricity consumption of TWh per year – that's more than entire countries such as Argentina and Ukraine, which consume and 0 ; Historical annualised electricity consumption · Annualised consumption. Power demand · Estimated consumption Annualised electricity consumption, ; Total Bitcoin.

According to one piece of AMD RX with the power consumption of W, we highly recommend you to adopt a 80 PLUS Platinum certified W power supply to. What percentage of the world's electricity does it use is much fairer. much as a dent in the behemoth that is Bitcoin energy use. Until. The Bitcoin Energy Consumption Index provides the latest estimate of the total energy consumption of the Bitcoin network. Bitcoin mining consumes roughly % of all energy consumption worldwide. Bitcoin uses more than 7 times as much electricity as all of Google's global. Bitcoin mining consumes roughly % of all energy consumption worldwide. Bitcoin uses more than 7 times as much electricity as all of Google's global. Typically, a rig will need at least Watts of power to run one or two GPUs and several fans needed to cool down the hardware. Some more. As a result, when a computer is hijacked for cryptocurrency mining, it often overheats and burns up. Also, % of your device's computing power may be used for. How Much Energy are We Talking? Due to the technical nature of blockchain, this number is projected to grow to TWh annually. WAYS to increase the. How much do crypto miners make? Is crypto mining taxed? Crypto mining is This means Bitcoin mining uses more electricity per year than many countries. How much power do I need to mine Bitcoin? The amount of power needed to mine Bitcoin depends on the mining operation. The more miners in the operation, the. The fact is that even the most efficient Bitcoin mining operation takes roughly , kWh to mine one Bitcoin. By way of comparison, the average US household. It is also the way new bitcoins are launched into circulation. Mining is conducted by miners using hardware and software to generate a cryptographic number that. Bitcoin mining, the process by which bitcoins are created and transactions are finalized, is energy-consuming and results in carbon emissions. It will take roughly months to mine a Bitcoin, which amounts to 15, kWh. Electricity Rates. Next, we looked at electricity rates per state. For this. The bitcoin miners they surveyed reported that 29% of their mining is powered by renewables. Many crypto miners are turning to renewable energy and using it to. Miner PSUs, on the other hand, are usually rated for VAC to VAC. Make sure that you know what voltage configuration is available at your facility and that. Following these steps will leave you with a very energy efficient bitcoin miner, as a Raspberry Pi only uses four watts of power, and a miner is typically W. This system Bitcoin uses is called proof of work because miners need to prove they expended computing power during the mining process. They do this when they. What Are the Economics of Mining Bitcoin? · Electricity: This is the power that runs your mining systems 24/7. · Mining systems: Contrary to the popular narrative. While mining rigs have various technical features, crypto miners are generally concerned with two above all else: hash rate and energy usage. The hash rate is.

Business Loan Personal Credit

Whether your credit is low because of your personal financial history or your business hasn't had a chance to accrue a strong business credit history, bad. With our Business Quick Loan, you get the flexibility to support your ongoing and future plans. Simply apply once to establish your credit limit, then access. If you have poor personal credit and you're wondering if it will affect your approval or the terms of your commercial loan, the answer is yes, it can. However. Generally, business loans from traditional lenders or backed by the SBA are not reported on personal credit reports. Instead, business credit bureaus track. With small-business loans being predictable, the payments go towards principle and interest. With a line of credit, you control the payment—which has its. Business credit scores impact the ability of a business to secure loans in the same way personal credit can affect an individual's ability to get a mortgage or. Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of. Good Credit Lending. When applying for a business loan, good credit is considered to be a personal FICO score within People with scores in this range. That said, if you're planning to apply for an SBA Loan, aim for a business and personal credit score of at least to improve your chances of qualifying. Is. Whether your credit is low because of your personal financial history or your business hasn't had a chance to accrue a strong business credit history, bad. With our Business Quick Loan, you get the flexibility to support your ongoing and future plans. Simply apply once to establish your credit limit, then access. If you have poor personal credit and you're wondering if it will affect your approval or the terms of your commercial loan, the answer is yes, it can. However. Generally, business loans from traditional lenders or backed by the SBA are not reported on personal credit reports. Instead, business credit bureaus track. With small-business loans being predictable, the payments go towards principle and interest. With a line of credit, you control the payment—which has its. Business credit scores impact the ability of a business to secure loans in the same way personal credit can affect an individual's ability to get a mortgage or. Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of. Good Credit Lending. When applying for a business loan, good credit is considered to be a personal FICO score within People with scores in this range. That said, if you're planning to apply for an SBA Loan, aim for a business and personal credit score of at least to improve your chances of qualifying. Is.

Most SBA loans allow you to borrow up to $5 million for business expenses. Most personal loan lenders will approve you for up to $, When might it make. PNC offers small businesses an unsecured business loan with no collateral required. Loan amounts range from $ to $ By thoroughly researching upfront, you can confidently choose the right lender, benefiting your business in the long run. Do you know your credit score? When. We set a pre-approved overall limit when you sign up for a business loan, and update it monthly based on your business performance. Draw as much (or as little). Your personal credit may come into play when you apply for a business loan. Since lenders may review your personal and business credit ratings, it's. Business loans have higher standards than regular personal loans because approval relies mostly on the state of your business. By preparing a solid business. SBA provides loan guarantees to lenders so lenders can make loans to eligible small businesses (business or personal) to provide the financing, and; Be able to. Low credit can be a challenge, but solid financials from the existing business can improve your chances with an SBA loan. Lenders will look at. Credit bureaus run calculations to determine a business and personal credit score for small business owners. The FICO score is a universally understood measure. Your personal credit score is an important factor when financial institutions are considering your loan application. Most lenders require borrowers to have a. Low credit can be a challenge, but solid financials from the existing business can improve your chances with an SBA loan. Lenders will look at. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Even though you're seeking funding to support a business, most lenders will consider your personal credit score when evaluating a small business loan. What a FICO score is to personal credit, BizAnalyzerTM is to business credit. Understanding how lenders will evaluate your risk as a borrower will empower. If you are the sole provider of finances to the company, akin to a sole trader, your personal credit score may come into calculations. If you. Small business loan requirements can vary depending on the lender and type of loan. Lenders might consider both the owner's and business' credit and finances. Thinking of applying for a business loan? Check your personal credit report before you submit your business loan application. Learn more. Review business loan options at Citizens. Find out how our business lending solutions - including loans and lines of credit - can help you meet your. SBA loans are one of the most popular lending options for entrepreneurs. These loans are backed by the U.S. Small Business Administration (SBA) to support small. Improve your chances of getting a good loan · Maintain a good business and personal credit history · Monitor your credit report for accuracy · Comparison shop for.

Carry On Luggage Airline Rules

A standard carry-on bag measures 55 cm ( in) in height, 23 cm (9 in) in depth, and 40 cm ( in) in width, while a personal item adheres to the. Individual airlines and the International Air Transport Association (IATA) both have a say in determining the size of allowable carry-on bags, but the exact. Your Carry-on bag must fit in the overhead bin, so it must be 9 in x 14 in x 22 in (23 cm x 35 cm x 56 cm). When measuring your bag, be sure to include the. * The maximum dimensions for these bags are 40x30x10cm each. If your item exceeds the total dimension of 80cm (the length, width and height combined), it will. For instance, many airlines have maximum dimensions and weights for hand luggage, and you are not allowed to carry more than one piece of hand luggage. It is. Before you pack, make sure your bags meet our checked bag size dimensions and weight requirements. Checked bags exceeding 62" ( cm) in overall dimensions. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). These dimensions include. You may bring one carryon bag and one personal item without charge (subject to the limitations below). The bag should be stowed in the overhead compartment. Most airlines will allow you to check one bag and have one carry-on bag. There is normally a maximum weight limit of 50 pounds per checked bag as well as a. A standard carry-on bag measures 55 cm ( in) in height, 23 cm (9 in) in depth, and 40 cm ( in) in width, while a personal item adheres to the. Individual airlines and the International Air Transport Association (IATA) both have a say in determining the size of allowable carry-on bags, but the exact. Your Carry-on bag must fit in the overhead bin, so it must be 9 in x 14 in x 22 in (23 cm x 35 cm x 56 cm). When measuring your bag, be sure to include the. * The maximum dimensions for these bags are 40x30x10cm each. If your item exceeds the total dimension of 80cm (the length, width and height combined), it will. For instance, many airlines have maximum dimensions and weights for hand luggage, and you are not allowed to carry more than one piece of hand luggage. It is. Before you pack, make sure your bags meet our checked bag size dimensions and weight requirements. Checked bags exceeding 62" ( cm) in overall dimensions. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). These dimensions include. You may bring one carryon bag and one personal item without charge (subject to the limitations below). The bag should be stowed in the overhead compartment. Most airlines will allow you to check one bag and have one carry-on bag. There is normally a maximum weight limit of 50 pounds per checked bag as well as a.

According to the US Federal Aviation Administration, passengers who are flying in the United States are limited to one carry-on luggage item and one personal. bring one carry-on bag and one personal item, along with one checked bag up to 23kg free of charge on most routes. The Delta baggage allowance is as follows. Carry-on bag size. The carry-on bag size limit for flights on all aircraft types is to 22'' x 14'' x 9'' - these dimensions include the wheels and handles. Be. Carry-On Baggage. Depending on the fare purchased, you can bring up to two free carry-on articles onboard and still have plenty of leg and elbow room. All carry-on items must meet Federal Aviation Administration (FAA) regulations and may not exceed 22" x 14" x 9". The FAA mandates that all carry-on items fit. Liquids carried in the aircraft cabin such as aerosols, drinks, toothpaste, cosmetic creams or gels must be carried in a transparent plastic bag - maximum. Some airlines will allow a third piece, but no carry-on piece may be taken. A good rule of thumb is that the first checked piece should not exceed a dimension. Carry-on bag size. The carry-on bag size limit for flights on all aircraft types is to 22'' x 14'' x 9'' - these dimensions include the wheels and handles. Be. You are limited to one (1) carry-on bag and one (1) personal item on any flights that we operate, except as stated otherwise in this Contract of Carriage. 7kg The briefcase may not exceed 45 x 35 x 20cm; the handbag may not exceed 55 x 38 x 22cm; the garment bag can be no more than 20cm thick when folded. You are allowed to bring a quart-sized bag of liquids, aerosols, gels, creams and pastes in your carry-on bag and through the checkpoint. Carry ons for international flights are usually a maximum of 22 inches (55cm) tall, 15 inches (40cm) wide, and 10 inches (25cm) deep. For all travel classes, each cabin baggage (including handles, casters, and side pockets) may not exceed 22 x 14 x 9 inches (56 x 36 x 23 cm) in size (length x. Liquids carried in the aircraft cabin such as aerosols, drinks, toothpaste, cosmetic creams or gels must be carried in a transparent plastic bag - maximum. The carry-on bag must fit in the overhead bin, with the maximum dimensions of 22 x 14 x 9 inches (including handles and wheels), and weigh no more than Personal Care ; Makeup, Yes, You can bring makeup on a plane; liquid, lotion, gel, paste, or creams must adhere to the ounce rule ; Electric Razors. Yes. None. If passengers have baggage allowance, items no more than 50x40x20 cm in size and 8 kg in weight can be taken on board as cabin baggage, while items checked in. Unfortunately no, the standard carry-on size is typically 22” x 14” x 9”, so a 24 inch bag is too large to bring on board of most economy standard airlines. 2. Depending on the fare purchased, you can bring up to two free carry-on articles onboard, including a personal item and a standard carry-on bag. For flying, there are two basic types of baggage: checked and carry-on sometimes referred to as "hold" and "hand" luggage, respectively, the latter even.